b&o tax credit

Taxpayers can use forms available on this website to make application to the Finance Director. It is recommended you consult.

The state BO tax is a gross receipts tax.

. All individuals and firms doing business in Bellingham whether located inside or outside the City limits must register with the City Finance Department and are subject to the business and. There is a transaction fee of 290 for credit card transactions. As your income goes up you get a smaller and smaller credit until you make enough to pay the full percentage.

The Seattle business license tax is applied to the gross revenue that businesses earn. Puyallup Main Street Association. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax.

In 2020 when you go to pay your BO. For this reason the Department of Revenue does not allow deductions for a Washington LLC or corporation paying. Regular mail through the post office.

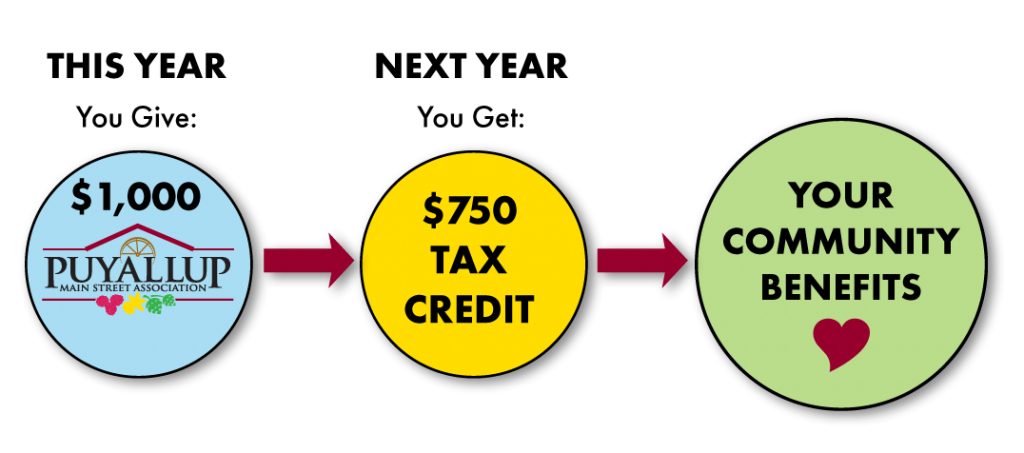

However the State does impose a gross receipts tax called the Business and Occupation Tax BO. Ad Prevent Tax Liens From Being Imposed On You. Make a pledge of as little as 1000 to Puyallup Main Street Association beginning January 10 to March 30 2022 pay the pledge to PMSA by November 15th and 75 of your pledge will be.

This rule explains the business and occupation BO tax credit for small businesses provided by RCW 82044451. PO Box 2514 Beckley WV 25802 Physical Address. Market Vines is a popular destination at Centre Market.

Unlike the retail sales tax a sale. CPA Professional Review. Maximize Your Tax Refund.

There is no income tax in Washington State. It is measured on the value of products gross proceeds of sale or gross income of the business. Washington unlike many other states does not have.

Ad Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. Effective June 7 2006 businesses that participate in the Washington Customized Training Program may take a BO tax credit for 50 percent of their payment to the training program. More information is available on the application and reporting forms or by calling the BO Tax.

Members of Wheeling City Council now will vote in early February. BO tax is calculated on the gross income from activities within the. However your business may qualify for certain exemptions deductions or credits.

Wheeling Finance Committee Approves BO Tax Credit. ACH payments using your checking accounts do not incur transaction fees. There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount.

409 S Kanawha Street Phone. Write the amount on page 2 under the Credits section of your return on the Small Business BO Tax Credit line. This is the amount of your Small Business BO Tax Credit.

Business Occupation BO Tax Credits. The BO tax for labor materials taxes or other costs of doing business. The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for contributions given to the Kent Downtown Partnership.

To break this down more if your check to SDA is 1000 then your 2013 B O Tax Credit is 750. 100s of Top Rated Local Professionals Waiting to Help You Today. An ordinance of the Council of the City of Fairmont enacted in part pursuant to the provisions of West Virginia Code Section 8-1-5a Municipal.

Contact Information Mailing Address. Small business tax relief based on income of business. Your 2012 IRS Deduction may be up to 1000.

New BO Tax Credit. Washington BO Tax Credits. You can make the donation by sending a check to the following address.

The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. Beginning October 1 2016 businesses that hire unemployed veterans may qualify for credit against their State business and occupation BO tax or public. So for example if you pay ServiceOther B O annually and your annual.

B O Tax.

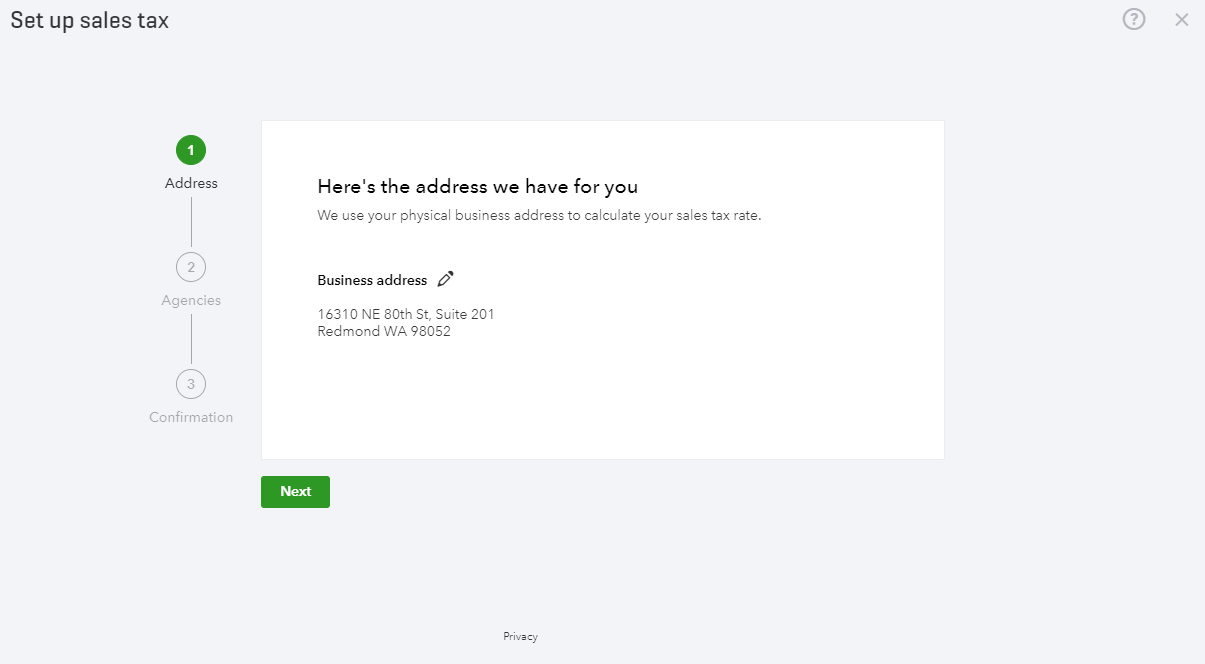

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

B O Railroad Train Sign Heritage Logos Baltimore Ohio Etsy Canada

Don T Miss The Washington State Tax Reconciliation Deadline

B O Tax Program Puyallup Main Street Association

Business And Occupation B O Tax Washington State And City Of Bellingham

Main Street Tax Credit Program In Washington

B O Tax Credit Program Sumner Main Street Association

Small Business Thanks Governor For Signing B O Tax Credit Bill

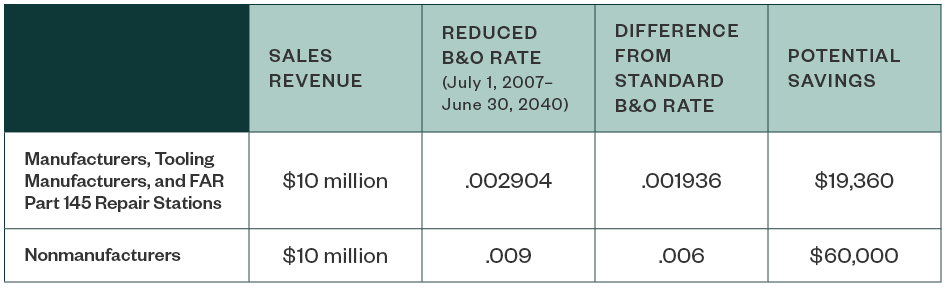

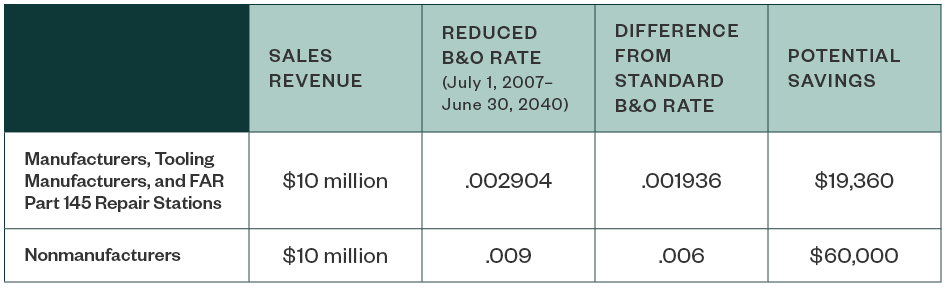

Washington Aerospace Tax Incentives

9712 Fairbanks Morse H12 44 Baltimore And Ohio Railroad Train Photography Train

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

%20Taxes/bo-tax-header.jpg)